More so than any other fossil fuel company, Occidental Petroleum — known as Oxy — has built its climate strategy around innovations that capture carbon before it can be emitted or pull it directly out of the air. The Texas-based oil giant, which made more than $23 billion in revenue last year, says on its website that these “visionary technologies” will help it achieve net-zero greenhouse gas emissions and enable a lower-carbon future.

Scientists agree that such technologies will be necessary to limit global warming. But Oxy’s plans for them appear to be less about sustainability and more about creating a “license to pollute,” according to a new analysis from the nonprofit Carbon Market Watch. The analysis describes Oxy’s focus on carbon capture and removal as a “costly fig leaf for business as usual,” allowing the company to claim emissions reductions while continuing to profit from the sale of fossil fuels — rebranded as “net-zero oil” and “sustainable aviation fuels.”

The company “makes this whole spiel about meeting the Paris Agreement’s goals, but it’s very clearly flying in the face of that,” said Marlène Ramón Hernández, an expert on carbon removal at Carbon Market Watch and a co-author of the report. “What we have to do is phase out fossil fuels, not perpetuate their life.”

Oxy first outlined its net-zero strategy in 2020, making it the first American oil major to do so. Today, Oxy describes that strategy using four R’s: The company says it will “reduce” operational emissions, “revolutionize” carbon management, “remove” carbon from the atmosphere, and “reuse/recycle” it to produce new low-carbon or zero-emissions products. Its overarching goal is to achieve net-zero emissions for its operations and indirect energy use by 2040.

This is where the problems begin, according to Carbon Market Watch. Despite Oxy’s net-zero pledge for its operation and energy use, it is much vaguer about the emissions associated with the oil and gas it sells. These emissions, known as Scope 3 emissions, represented more than 90 percent of Oxy’s greenhouse gas footprint in 2022. The company has asserted an “ambition” to zero them out by 2050.

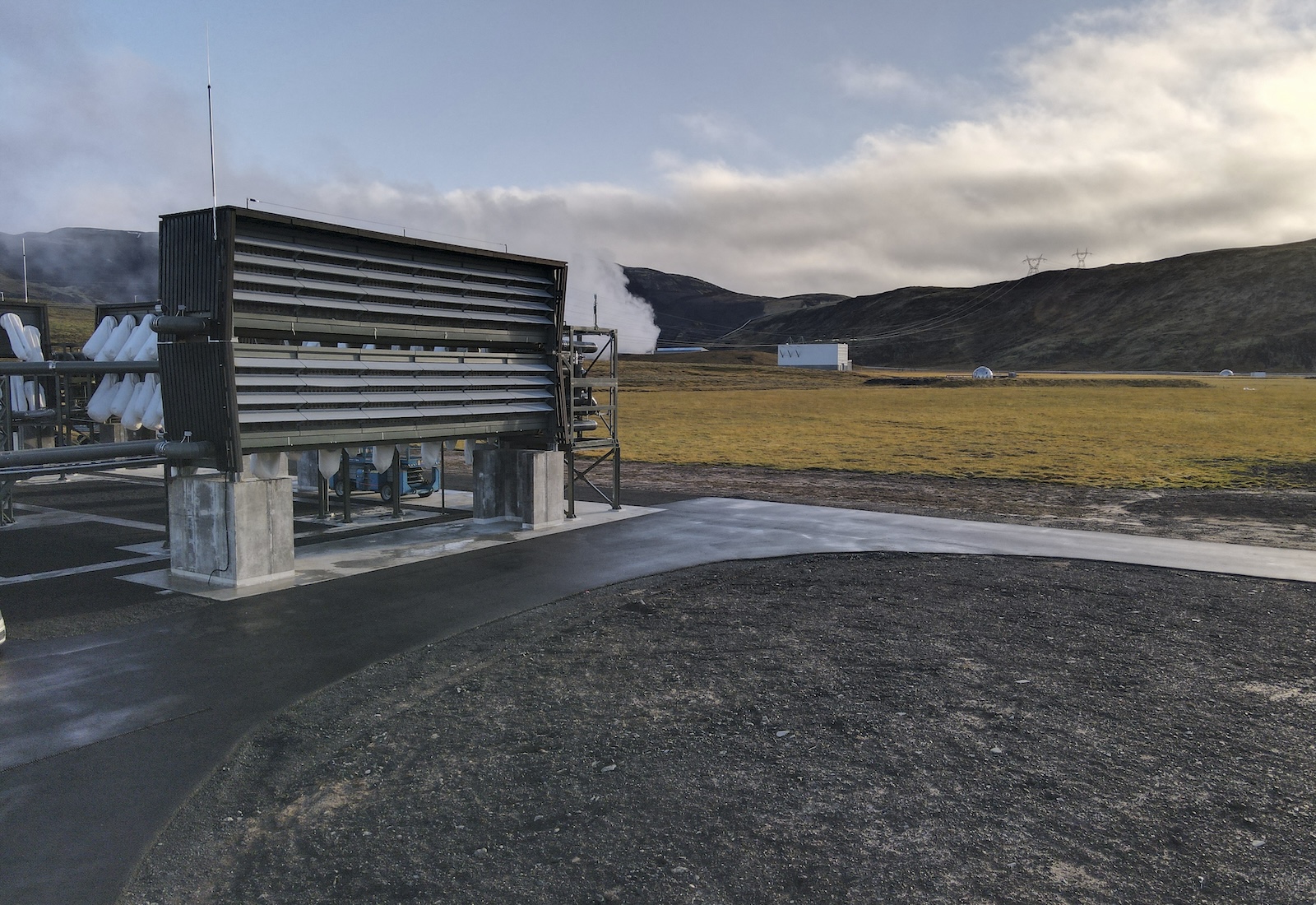

However, Oxy does not plan to reduce Scope 3 emissions by phasing down the production of oil and gas, but through investments in carbon removal. Direct air capture, or DAC — a technology that uses large fans and chemical reactions to separate carbon dioxide from the air — is a main focus. An Oxy subsidiary called Oxy Low Carbon Ventures announced in 2022 that it would deploy up to 135 DAC plants by 2035, and last year Oxy bought a major DAC technology company for $1.1 billion.

Halldor Kolbeins / AFP via Getty Images

Some of Oxy’s DAC projects are already in the pipeline. The largest, called Stratos, is under construction in the Permian Basin, a massive oil field, in Texas. If it reaches its nameplate capacity of capturing half a million metric tons of carbon dioxide a year — which Oxy says it will do by mid-2025 — it will be 14 times larger than the biggest DAC facility in the world. (That facility, owned by the Swiss company Climeworks, began operating in Iceland this week with a nominal capacity of 36,000 metric tons of CO2 per year.)

In order for DAC to result in net removal of carbon dioxide, however, captured carbon has to be kept out of the atmosphere for good. This is usually achieved by locking it up in rock formations. Oxy CEO Vicki Hollub, however, has said this would be a “waste of a valuable product,” and instead plans to use the captured carbon. In one application, it would be converted into synthetic electrofuels — low-carbon fuels produced from their chemical constituents using electricity — and sold to other companies.

The other major application is for a process known as enhanced oil recovery, where CO2 is injected into oil and gas wells in order to extract hard-to-reach reserves of fossil fuels. This forms the basis for Oxy’s “net-zero oil” claims. According to the company’s logic, the atmospheric carbon dioxide injected into the ground cancels out any new emissions from the oil and gas it’s used to pull up. In an interview with NPR last December, Hollub said this approach means that “there’s no reason not to produce oil and gas forever.”

Before that, at a conference last March, Hollub told audience members that DAC would be “the technology that helps to preserve our industry over time,” extending its social license to operate for “60, 70, 80 years.”

Neither Carbon Market Watch nor the independent experts Grist spoke to look favorably on these approaches. Charles Harvey, a professor of civil and environmental engineering at MIT who was not involved in the report, called it “absurd” to use captured carbon to make so-called sustainable aviation fuels; these fuels will eventually be burned, re-releasing the captured carbon back into the atmosphere.

In fact, the whole process may result in a net increase in greenhouse gas emissions, since DAC is an energy-intensive process that is often powered by fossil fuels. Oxy has no publicly announced plans to power its carbon capture and removal facilities with renewable energy. “They’ll be releasing more CO2 than they’re capturing,” Harvey said.

As for “net-zero oil,” Carbon Market Watch calls it an “oxymoron and a logical fallacy.” A 2021 analysis by the U.S. Department of Energy’s National Energy Technology Laboratory suggests that this application would also result in net-positive emissions — both because it takes so much energy (likely supplied by fossil fuels) just to run a DAC plant, and, because every metric ton of carbon dioxide injected into oil fields extracts two to three barrels of oil. Each barrel of oil generates half a metric ton of carbon dioxide when burned, which means each metric ton of carbon dioxide used for Oxy’s net-zero oil may create 1 to 1.5 tons of CO2 emissions.

Brandon Bell / Getty Images

Hernández said she is also concerned about Oxy’s plans to generate carbon credits from its DAC projects. Even though none of its planned DAC facilities has been built yet, Oxy has already pre-sold or is in negotiations to sell DAC-generated carbon credits representing between 1.63 million and 1.98 metric tons of carbon dioxide, according to Carbon Market Watch’s calculations. If the company uses the same captured carbon to offset its own emissions and generate credits, which can be used to offset the emissions of another company, “This is a blatant issue of double-counting,” Hernandez told Grist.

Oxy did not respond to Grist’s request for comment.

Holly Jean Buck, an assistant professor of environment and sustainability at the University of Buffalo, said it’s possible to pursue DAC responsibly. Even a moonshot project like Stratos could be seen as having an important demonstration or research value. “The point is to figure out if the technology is going to work at a real-world level,” she told Grist.

That said, she agreed there are ways Oxy could make its DAC agenda more credible. “They could make a commitment to building renewable power to power it,” she offered, or donate the technology to developing countries.

Buck and some other academics say fossil fuel companies should be doing more of this research — or at least footing the bill for it — in order to take responsibility for their role in the climate crisis. Harvey, however, argues there’s an opportunity cost to such research and deployment, which is expensive. He and other researchers have estimated that it will cost Oxy’s Stratos facility $500 to capture each metric ton of carbon dioxide. (The company predicts costs will fall to around $200 per ton by 2030.)

Every dollar spent on DAC means a dollar not spent on more reliable, immediate emissions reductions. “There’s low-hanging fruit to do before you get there,” he said, like building renewable energy for non-DAC purposes, insulating houses, installing heat pumps, or putting more batteries on the grid with existing renewables.

“Almost anything is better” than DAC, Harvey said.

As an essential first step toward a more credible net-zero strategy, Hernández suggested that Oxy abandon its aggressive plans to extract more oil and gas, since doing so is misaligned with scientists’ call for a dramatic cut in production in order to limit global warming to 1.5 degrees Celsius (2.7 degrees Fahrenheit). “It’s actually planning to increase its oil production, so there is clearly no intention there to transition to net-zero,” she said.

This story was originally published by Grist with the headline Occidental Petroleum’s net-zero strategy is a ‘license to pollute,’ critics say on May 9, 2024.